Business Law Blog

Read Articles by Motiva Business Law

How Can An Employee Can Buy Stock in Their Company?

February 11, 2025

How an Employee Can Buy Stock in Their Company: A Guide for Wesley Chapel and North Tampa Business Professionals There are many ways an employee ...

Read More

The Roles and Responsibilities of a Merger & Acquisition Lawyer

October 29, 2024

A merger and acquisition (M&A) lawyer specializes in legal matters related to corporate transactions where companies combine or purchase one another. These legal professionals guide ...

Read More

Mergers and Acquisition: Definition, Types, Benefits, Process, History and Importance Of A Lawyer

October 29, 2024

What Are Mergers and Acquisitions (M&A)? Mergers and acquisitions, also known as M&A, refers to the process of consolidation between two companies and/or their assets. ...

Read More

What is a DBA and Does Your Business Need One?

October 28, 2024

A DBA, or “Doing Business As,” allows businesses to operate under a name that differs from their legally registered name. This setup is ideal for ...

Read More

Should I Franchise My business?

October 27, 2024

Should I Franchise My Business? Whether you should franchise your business depends on a few factors. Franchising your business is a great way to grow ...

Read More

Top Business Jobs and Career Paths

October 24, 2024

Business jobs span industries and roles from entry-level to executive positions in fields like accounting, finance, marketing, and HR. Understanding these paths helps guide career ...

Read More

Understanding Business Finance: What It Is and Why It Matters

October 23, 2024

Business finance involves managing a company’s funds to ensure sustainability and growth. It helps businesses meet operational needs, manage risks, and make informed decisions. Businesses ...

Read More

How to Write a Business Plan for a Startup Business

October 22, 2024

This document acts as a roadmap for your business, outlining everything from market analysis to financial projections, making it essential for attracting investors and stakeholders.

Read More

Buying a Business in Florida

August 1, 2024

How do I buy a business in Florida? The process of buying a business is notably different in Florida than in other states. It is ...

Read More

FTC Bans Non-Compete Agreements

April 25, 2024

Are Non-Compete Agreements Banned? On April 24, 2024, the Federal Trade Commission (FTC) issued a rule banning non-compete agreements for employees. It will become effective ...

Read More

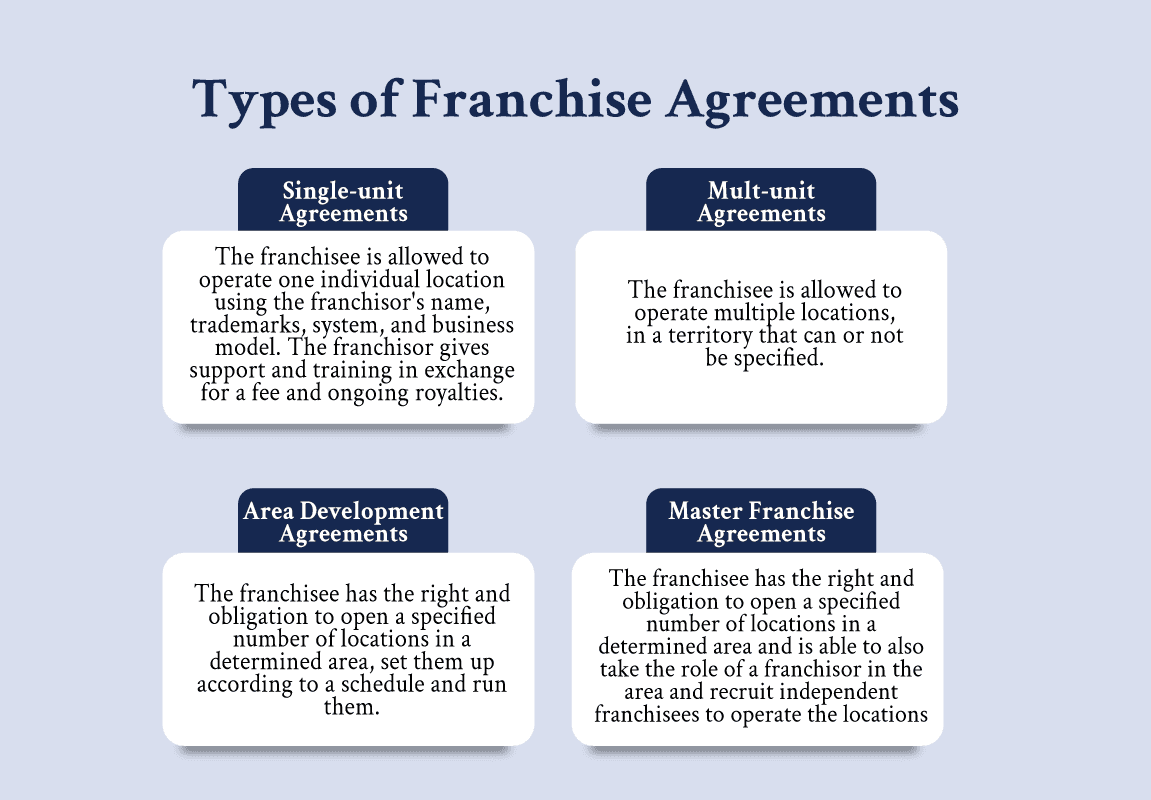

The 4 types of franchise agreements

March 25, 2024

Franchise agreements can be divided into two main categories, single-unit and multi-unit franchise agreements. However, there are different variations of multi-unit franchise agreements in which ...

Read More

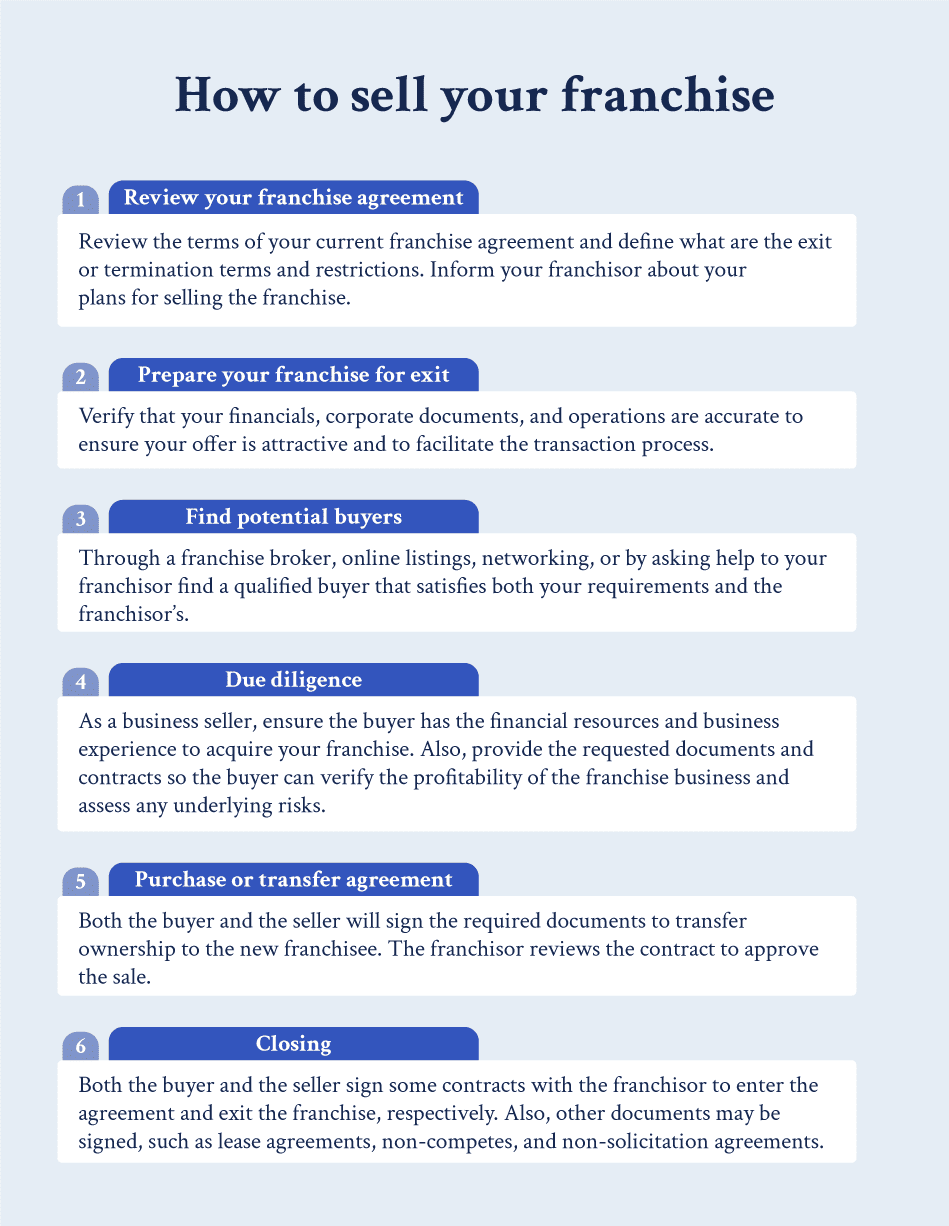

How to sell your franchise business as a franchisee

February 27, 2024

As a franchisee, you may want to sell your franchise for a variety of reasons. Retirement, the franchise not being what you expected, or chasing ...

Read More